Li2CO3 Pirce Recently

Li2CO3 futures fell near to 200,000 RMB/Ton recently.

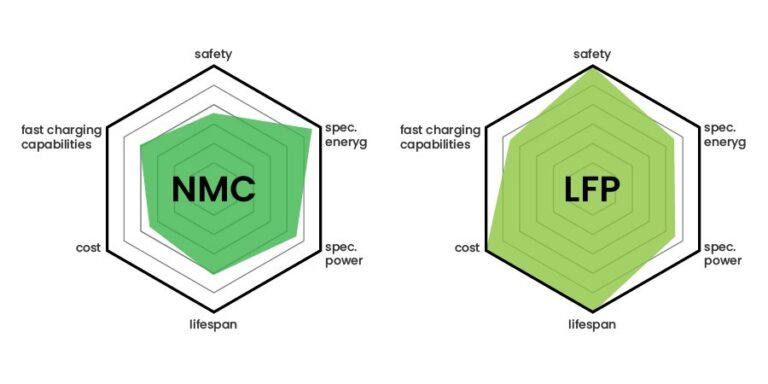

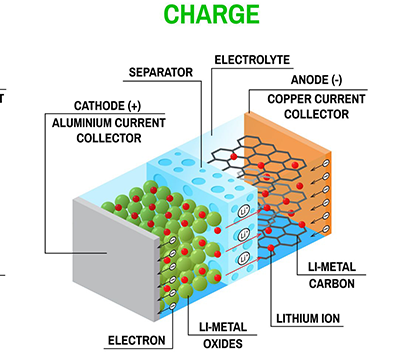

Recently, the price of lithium battery materials has changed from a high price situation, and the prices of key lithium battery materials, including Li2CO3, LiPF6, LFP, and NCM, have fallen.

Previously, due to the game between the upstream and downstream of the industrial chain, the price of Li2CO3 caused severe shocks and affected a series of chain reactions such as downstream materials. In late April this year, upstream lithium mine manufacturers were reluctant to sell at high prices, coupled with Hunan Yuneng, Defang Nano, Tianci Materials and other major material manufacturers’ production schedules rebounded and orders were driven, the market price of battery-grade Li2CO3 rose all the way to nearly 320,000 RMB/ton .

Lithium battery material price “high price” support point is gradually lost.

From the perspective of changes in the price of lithium battery materials, from the end of April to mid-May, the price of lithium battery materials collectively stabilized and rebounded rapidly; in late May, the price of lithium battery materials remained at a relatively balanced level.

This period was mainly due to the rapid inventory replenishment of midstream materials and battery manufacturers. Taking Longpan Technology as an example, its shipments of lithium iron phosphate from April to June reached 6,911.15 tons, 12,073.66 tons, and 12,372.75 tons, a month-on-month increase of 71.53%. 74.7%, 2.48%. Defang Nano also said that its capacity utilization from April to June climbed from a low level to full production and sales.

Lithium salt manufacturers quickly resumed supply from the production reduction of lithium carbonate in the first quarter. Taking Salt Lake as an example, according to the data disclosed by it, its lithium carbonate output in the first quarter was 6,300 tons, and its sales volume was 1,400 tons. In the second quarter, its lithium carbonate output was 7,800 tons. The sales volume is 13600 tons. In June, Salt Lake Co., Ltd. further stated that its daily output of lithium carbonate has reached more than 100 tons.

Behind the price drop of lithium battery materials again, it is precisely that the speed of upstream supply increase has quickly caught up with the speed of downstream demand recovery.

On the other hand, after experiencing turbulent market cycles, the procurement strategies of mid- and downstream manufacturers of lithium batteries have gradually become more conservative. Compared with the past stockpiling in advance and large-scale expansion of production, more manufacturers have turned to production according to market rhythm and maintaining high turnover. inventory strategy.

24/7, 2023